From Torque to Tension: When Distributorship Dreams Unwind

What happens when a long-standing distribution relationship morphs into a promise of “forever” — and then collapses under the weight of commercial reality?

What happens when a long-standing distribution relationship morphs into a promise of “forever” — and then collapses under the weight of commercial reality?

That’s the story in Torc Solutions Pty Ltd v Unex Corporation d/b/a Hytorc [2025] FCA 1124, where the Federal Court had to untangle claims of perpetual agreements, economic duress, misleading conduct, and an alleged “termination strategy”.

The Background

Torc Solutions was the Australasian distributor of torque wrenches and industrial tools sold by US entities Torc LLC and Hytorc.

When Torc LLC shut down globally in 2020, Torc Solutions looked to keep its business alive through a home-branded (“private label”) supply deal with Hytorc.

A teleconference between the parties fuelled Torc’s belief that an ongoing “Hytorc Agreement” had been struck, giving them perpetual supply rights on the same terms as their earlier Distributor Agreement.

Later, a formal Branded Product Distribution Agreement (BPDA) was signed. When that deal fell apart over insurance requirements and Hytorc’s decision that the arrangement was no longer viable, Torc alleged that:

-

a binding agreement already existed from the teleconference,

-

the BPDA was signed under economic duress, and

-

Hytorc had engaged in misleading, deceptive, and unconscionable conduct.

The Court’s Findings

Justice Neskovcin dismissed all claims by Torc, finding:

-

No perpetual contract – Courts rarely find distributorships to be “forever agreements”. The Distributor Agreement ended when Torc LLC closed.

-

No binding teleconference deal – The discussions fell into Masters v Cameron’s third category: “we’ll get something in writing later”. No enforceable contract arose until the BPDA was executed.

-

No duress – Telling a counterparty “sign the agreement or we won’t supply” was not unlawful pressure, but part of hard commercial bargaining.

-

No misleading or unconscionable conduct – The evidence didn’t support that Hytorc had promised supply it never intended to provide.

Bottom line: application dismissed.

Why It Matters

For brand owners and distributors alike, the lessons are sharp:

-

Paper it, or risk it – A teleconference transcript doesn’t replace a signed agreement.

-

“Forever” is a fantasy – Unless clearly expressed, distributorships and licences will be terminable.

-

Economic duress is hard to prove – Commercial pressure, even bluntly applied, rarely crosses the line.

-

Don’t over-rely on private label promises – A failed transition can leave the distributor exposed.

This case is a reminder that distribution and licensing deals live and die by what’s actually written down.

The Federal Court has handed down its first civil penalty judgment under the Online Safety Act 2021 (Cth), in eSafety Commissioner v Rotondo (No 4) [2025] FCA 1191.

The Federal Court has handed down its first civil penalty judgment under the Online Safety Act 2021 (Cth), in eSafety Commissioner v Rotondo (No 4) [2025] FCA 1191. When Tiger Woods launched his new Sun Day Red brand with TaylorMade, it came with a sleek “leaping tiger” device mark. Puma — owner of the iconic leaping cat logo used since 1968 — wasn’t impressed.

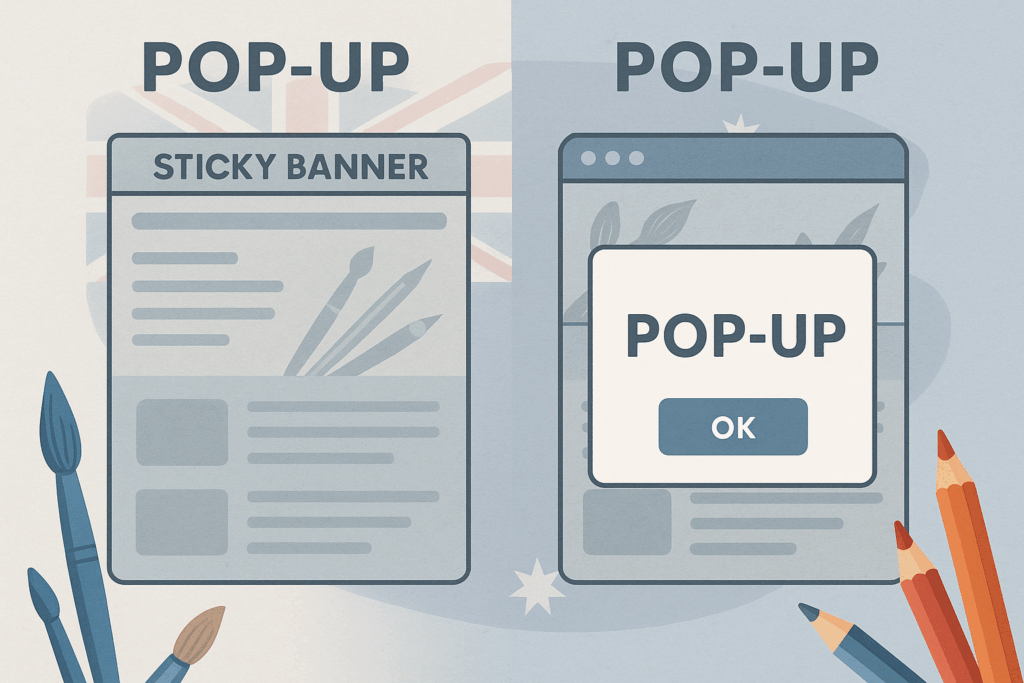

When Tiger Woods launched his new Sun Day Red brand with TaylorMade, it came with a sleek “leaping tiger” device mark. Puma — owner of the iconic leaping cat logo used since 1968 — wasn’t impressed. When two businesses with nearly identical names lock horns, things usually come down to trade marks, passing off, and reputation. But in Jacksons Drawing Supplies Pty Ltd v Jackson’s Art Supplies Ltd (No 2) [2025] FCA 1127, the real fight was over disclaimers, pop-ups, sticky banners, and user attention spans.

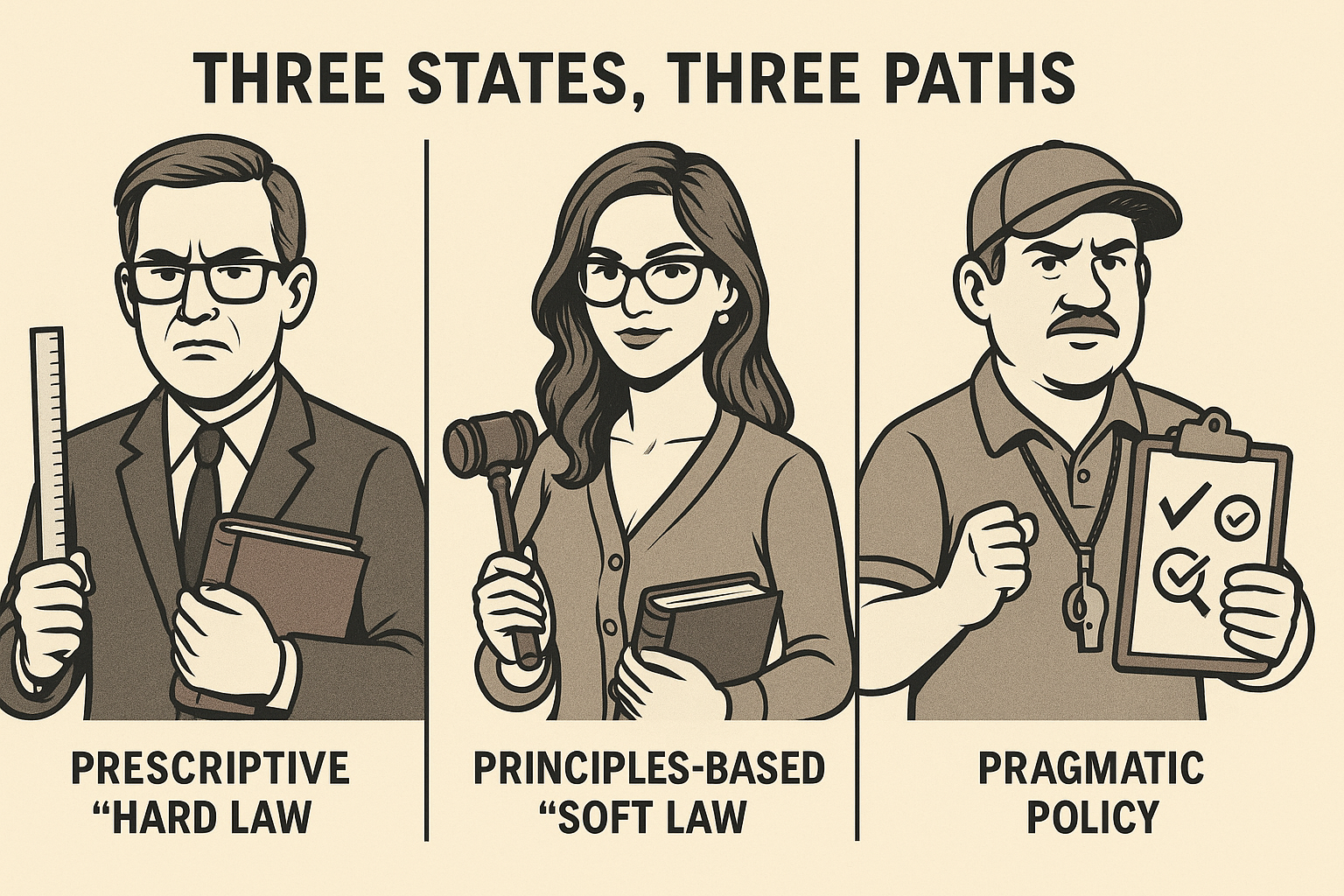

When two businesses with nearly identical names lock horns, things usually come down to trade marks, passing off, and reputation. But in Jacksons Drawing Supplies Pty Ltd v Jackson’s Art Supplies Ltd (No 2) [2025] FCA 1127, the real fight was over disclaimers, pop-ups, sticky banners, and user attention spans. Australia’s courts are no longer sitting on the sidelines of the AI debate. Within just a few months of each other, the Supreme Courts of New South Wales, Victoria, and Queensland have each published their own rules or guidance on how litigants may (and may not) use generative AI.

Australia’s courts are no longer sitting on the sidelines of the AI debate. Within just a few months of each other, the Supreme Courts of New South Wales, Victoria, and Queensland have each published their own rules or guidance on how litigants may (and may not) use generative AI. From ChatGPT hallucinations to deepfakes in affidavits, Queensland’s courts have drawn a line in the sand.

From ChatGPT hallucinations to deepfakes in affidavits, Queensland’s courts have drawn a line in the sand.